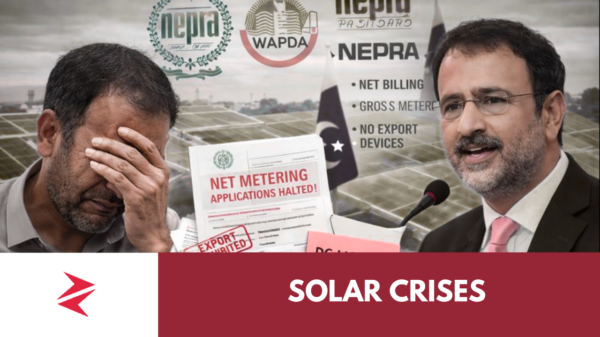

The infighting and lack of decisive action, coupled with the IMF’s holiday break and negative economic indicators, increased chaos and uncertainty in the economy. The government is now seeking financial assistance from China, the UAE, and Saudi Arabia, but these efforts may be complicated by changing circumstances in these countries. It is hoped that Dar will cooperate with the IMF and work to stabilize the economy.

Related: How much Islamic is Islamic Banking?

The Finance Minister, Ishaq Dar, currently lacks the resources needed to address economic challenges as he has done in the past. He is seeking funding from a variety of sources, including the IMF, World Bank, ADB, China, the UAE, and Saudi Arabia. If he is able to obtain this funding, it is believed that he will attempt to appreciate the Pakistani rupee, which may lead to further economic instability within 24 hours.

What happens if Pakistan’s Economy defaults?

If Pakistan’s economy defaults, it would mean that the country is unable to meet its financial obligations and is unable to pay back its debts. This could have serious consequences, both for the Pakistani government and for the country’s citizens. It could lead to financial instability, a decline in the value of the Pakistani rupee, and difficulty obtaining loans in the future. It could also lead to social and political unrest, as people may become disillusioned with the government’s ability to manage the economy effectively. In the worst-case scenario, an economic default could lead to economic collapse, which could have far-reaching and devastating consequences for the country.