Silver has officially surged past $117, delivering a 100%+ return in roughly two months. In traditional markets, that kind of move is not just rare — it is diagnostic. It tells you something has broken in the normal pricing of risk, time, and trust.

This rally did not emerge from speculative frenzy. It began quietly, during a period when bond yields remained elevated and risk assets were supposedly “priced for stability.” That contradiction mattered. When real assets accelerate despite high yields, markets are no longer debating returns. They are questioning currency durability.

Silver did not rally because investors suddenly fell in love with metals. It rallied because it sits at the intersection of monetary distrust and physical reality. Historically, silver leads when confidence erodes subtly, before panic sets in. Gold follows to confirm. Everything else reacts later.

That sequence is repeating — almost mechanically.

What makes this episode different is velocity. A calm doubling in 60 days is not healthy price discovery; it is capital repositioning under constraint. This is why late buyers are punished while early participants appear “lucky.” The market is not rewarding bravery — it is rewarding timing and restraint.

Calls for $130–$150 silver are not signals of strength. They are signals of crowd formation.

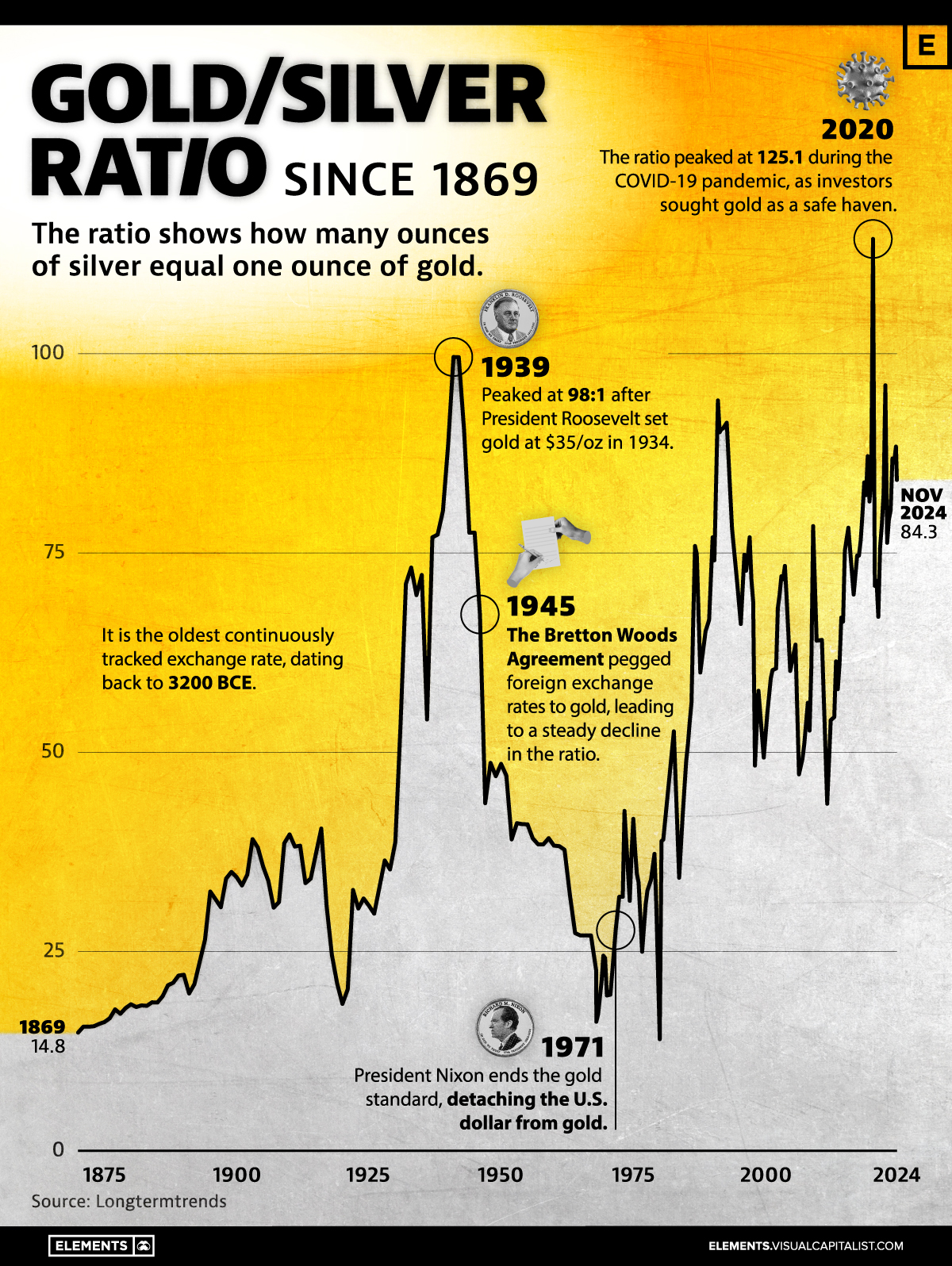

That is why the more important indicator now is not price, but the Gold-to-Silver Ratio (GSR). Historically, when the ratio compresses aggressively toward 40, silver is no longer leading — it is being exhausted. Smart capital does not exit risk; it rotates. Selling silver into gold at extreme GSR compression has repeatedly outperformed outright liquidation.

This is not about predicting tops. It is about respecting structure.

The broader implication matters more. Metals do not move like this in isolation. They move when the system is quietly repricing long-term trust. That repricing rarely stops at commodities.

Bitcoin’s relative lag during the early phase is not a failure of the thesis — it is part of it. Bitcoin tends to move after metals, once conviction spreads and participants stop hedging around the system and start hedging against it. Gold and silver signal stress. Bitcoin absorbs the conclusion.

Importantly, this does not mean an immediate, vertical handoff. Transitional phases include hesitation, technical pullbacks, and disbelief. That is normal. Structural rotations unfold over quarters, not days.

What comes next is not another silver entry. It is capital asking a harder question:

If fiat risk is the problem, what scales as the solution?

Metals preserve value. They do not move value efficiently in a digital world. That is where Bitcoin re-enters the conversation — not as a trade, but as monetary infrastructure with fixed supply and global settlement.

Silver’s move was the warning shot.

Gold confirmed it.

Bitcoin is not late — it is waiting for certainty to replace caution.

And certainty is now forming.